The Toronto Central Real Estate Market - shows pricing resilience in detached & semis

Detached homes averaged $2.40M, with sellers receiving 97% of their asking price—showing steady pricing even in a cooling sales environment. However, the number of detached homes sold fell to 173, down 18% year-over-year. Inventory continues to build, with 853 active listings, more than double what we saw this time last year (+133% Y/Y). Homes also took longer to sell, averaging 29 days on the market, up from 17 days last year.

In contrast, semi-detached homes had a stronger showing. The average sale price climbed to $1.64M, and homes sold for 104% of asking, suggesting competitive offers. Sales rose 13%, with 63 units sold. Inventory also increased (+180% Y/Y), yet properties moved faster than last year 16 days on market, down from 18 last year.

Condos remained the most affordable choice, with an average price of $950K and a 99% ask-to-sell ratio. However, sales dropped 28%, with just 46 condos sold, and inventory increased to 3475 active listings—a 41% increase year-over-year. Properties took longer to sell too, averaging 25 days on the market, compared to 17 a year ago.

In March, Toronto Central’s housing market showed resilience but clear signs of shifting. Detached homes stayed pricey at $2.4M but saw an 18% drop in sales and a sharp 133% rise in listings, meaning sellers may need to reset expectations. Semi-detached homes outperformed with rising prices, faster sales, and a 13% bump in transactions—buyers are still motivated at this price point. Condos remain the most affordable entry into the market, but with inventory up 39% and sales down 28%, buyers now have more room to negotiate. For sellers, smart pricing and strong marketing are essential; for buyers, there’s fresh opportunity—especially in the detached and condo segments.

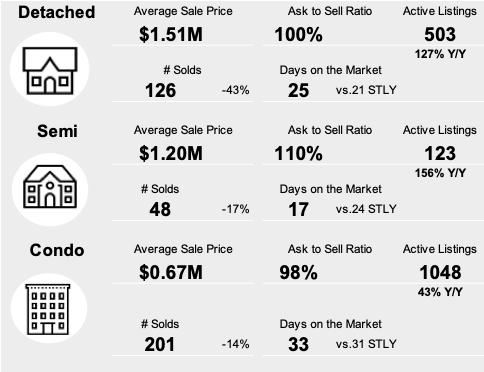

Toronto West Real Estate Market – Strong Prices Hold, But Inventory Rises Across the Board

The Toronto West market continues to show solid pricing power, even as inventory builds and sales activity shows slight declines.

Detached Homes: The average sale price rose to $1.55M, with sellers achieving 101% of their asking price, indicating healthy competition. Sales dipped slightly by 5%, with 210 homes sold, and homes spent an average of 21 days on market (up from 18 days last year). Inventory increased 169% year-over-year, now sitting at 677 active listings, suggesting sellers may face more competition this spring.

Semi-Detached Homes: Semis continued to outperform on price strength, averaging $1.15M and selling for 106% of the asking price. However, sales declined 7% (71 homes sold). Still, homes moved faster than last year—17 days on average, down from 19. Inventory also rose significantly, with 159 active listings—a 152% increase compared to March 2024.

Condos: Condos remained the most budget-friendly option at an average of $790K, with a 99% ask-to-sell ratio. Sales were relatively flat, with a 2% increase year-over-year (45 units sold). However, buyers are taking longer to decide, with the average days on market jumping to 30 (up from 24 last year). Condo inventory climbed to 1048 active listings, a 43% rise year-over-year.

Toronto West remains a strong market for sellers when it comes to price—homes are still selling close to or above asking. But rising inventory across all home types means buyers have more choice, and that could shift the balance in the coming months. Detached and semi-detached homes are still moving well, especially if priced right. Condos are taking longer to sell, so sellers in that segment should be ready to stand out. Whether you're buying or selling, the spring market will demand strong strategy and realistic expectations.

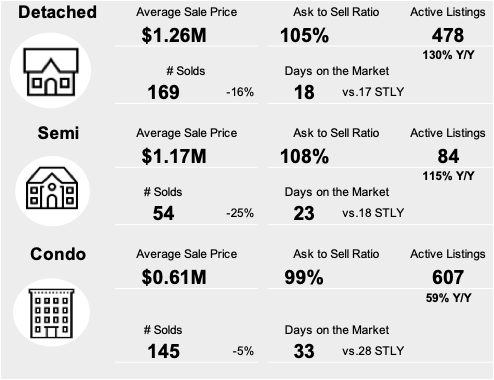

Toronto East Real Estate Market – show price resilience and rising inventory

The Toronto East housing market saw price resilience but declining sales activity in March. Rising inventory across all property types suggests a potential market shift, with buyers gaining more options and possibly more negotiating power in the coming months.

Detached Homes: Prices remained solid at $1.26M, with sellers achieving 105% of asking price. However, sales fell 16% (169 homes sold), and inventory surged 130% Y/Y. Homes still moved quickly, with 18 days on market (vs. 17 STLY), but rising supply could lead to softer pricing ahead.

Semi-Detached Homes: Sales dropped 25% (54 sold) despite an average price of $1.17M and a 108% ask-to-sell ratio. Days on market increased to 23 (vs. 18 STLY), and inventory jumped 115% Y/Y, indicating more supply and longer selling times.

Condos: The most affordable segment, averaging $600K, with a 99% ask-to-sell ratio. However, sales fell 37% (96 sold), and days on market increased to 31 (vs. 28 STLY). Inventory rose 59% Y/Y, suggesting slower absorption and potential price adjustments ahead. Prices remain firm, but declining sales and rising listings signal a shifting market. Detached and semi-detached homes still attract strong offers, but condos face longer selling times. Sellers should watch inventory trends and adjust pricing as needed.

Navigating Toronto’s shifting market requires the right strategy. If you're thinking of selling, don't leave money on the table. Contact me today for a data-driven pricing strategy that ensures you sell at the best price in the shortest time!

📩 Message me now if you would like to chat about Toronto real estate!